Commercial Fraud Prevention in the Digital Age

Credit Agencies, Big Data Providers, and Digital-Native Platforms to the Rescue

Fraud is no longer confined to shadowy backrooms or elaborate paper trails. Today, it is a fast-moving, digital threat that adapts as quickly as the technology designed to stop it. As the global marketplace grows more interconnected and transactions shift online, businesses face an unprecedented wave of commercial fraud attempts, from sophisticated “bust-out” schemes to synthetic identity fraud that blends real and fabricated data. The stakes are high: the global fraud detection and prevention market is projected to soar from $29.5 billion in 2022 to over $250 billion by 2032, fueled by the relentless pace of digital transactions.

Against this backdrop, the business information marketplace is undergoing a dramatic transformation. Traditional credit agencies, big data risk intelligence providers, and digital-native fraud platforms are racing to outpace fraudsters, each offering distinct strengths and facing unique challenges. Whether it’s the deep historical insight of legacy credit bureaus, the investigative power of big data analytics, or the real-time, AI-driven agility of cloud-native platforms, the tools for fraud prevention are more advanced and more essential than ever.

Firsthand Experiences Investigating Credit Fraud

A recent article in this publication, “Desperate Times Invite Business Fraud," prompted me to reflect on my initial experience with commercial fraud. In the late 1970s, as a credit analyst reporter with Dun & Bradstreet, I conducted street-level investigations of "bust-outs" in Westchester County, NY. Most of my inquiries revealed closed storefronts where the perpetrators had fled before my arrival. I recall discovering one store in Mount Vernon, NY, where the landlord guided me through the building from the front door, where inventory was received, to the back door, where the goods were loaded onto trucks and taken to unknown locations, never to be seen or paid for.

This article effectively outlines specific industries and key considerations for preventing bust-out fraud, which exploits credit systems by accumulating credit debt with no intention of repayment. This scheme often involves initially creating a credible credit profile, making regular payments to build trust, and then suddenly amassing substantial credit debt across multiple accounts from various credit grantors. These fraudsters may use stolen or synthetic identities, complicating detection efforts. It is important to note that businesses themselves do not commit fraud; rather, individuals within the business context do so. The impact of bust-out fraud can be severe, leading to significant financial losses for lenders and credit institutions.

The Rise of Digital Fraud Prevention Tools

Another Trade Credit & Liquidity Management article, "Automating Fraud Prevention in B2B Credit,” reports on how Bectran, an order-to-cash software provider, has partnered with Ekata by Mastercard to enhance fraud prevention in B2B credit operations. Ekata uses modern technology to help customers prevent synthetic identity fraud, which merges genuine information with fabricated details to create new synthetic identities.

These new digital-native fraud prevention platforms, along with traditional commercial credit reporting companies and big data risk intelligence providers, are now integral to the evolving commercial fraud prevention marketplace. This evolution is driven by increasingly sophisticated fraud techniques and the adoption of advanced technologies such as artificial intelligence (AI), machine learning (ML), and big data analytics.

Fraud Prevention Is Driving Expansion of the Business Information Marketplace

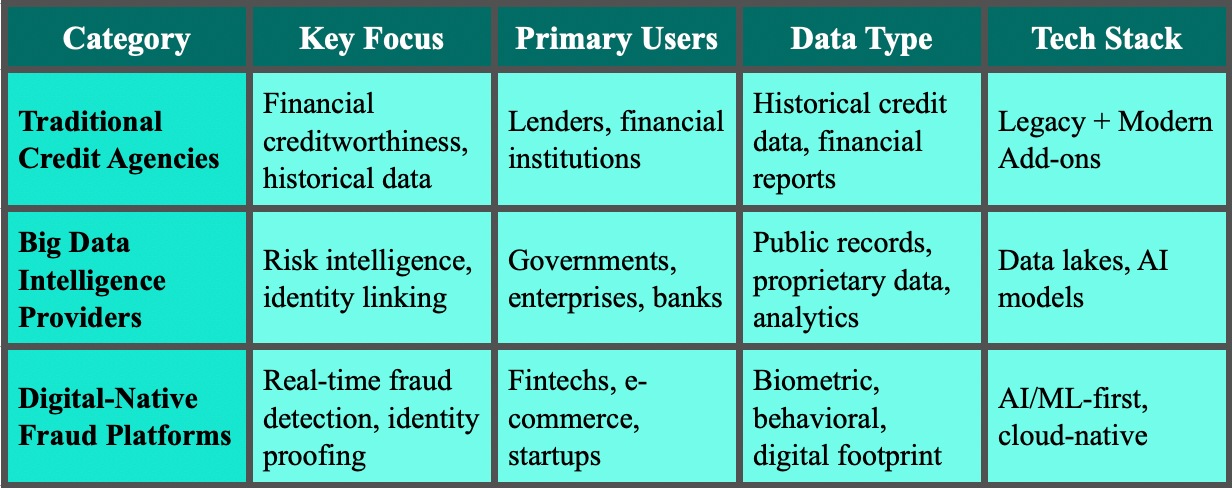

For all the use cases requiring business information that I discussed in my previous article, "Analysis of the Expanding Business Information Marketplace," fraud prevention remains the leading data capability. As part of my ongoing investigation into the Business Information Marketplace, I’ve begun categorizing key players in the fraud prevention space into three segments:

Traditional credit reporting agencies

Big data risk intelligence providers

Digital-native fraud platforms

Below, I share detailed comparisons among these high-level segment types and compare the benefits of specific vendors in this space.

Market Overview

As already noted, according to a press release by Allied Market Research, the global fraud detection and prevention (FDP) market is projected to grow significantly, with estimates indicating an increase from $29.5 billion in 2022 to $252.7 billion by 2032, reflecting a compound annual growth rate (CAGR) of 24.3%. Key drivers of this growth include the proliferation of digital transactions, regulatory compliance requirements, and the need for real-time fraud detection solutions.

High-Level Comparison by Category

Functional Comparison by Category

Key Players by Category

Summary of Pros and Cons

Traditional credit agencies are ideal when you need a macro-level risk profile based on long-term credit history, especially in lending and trade credit contexts.

Big Data providers shine when tackling complex fraud rings or compliance-heavy workflows, particularly in regulated or investigative environments.

Digital-native platforms are best suited for real-time, user-centric environments like B2B digital onboarding, e-commerce, and fintech, where speed and user experience are crucial.

More Details on Key Players

Traditional Credit Reporting Agencies

Dun & Bradstreet (www.dnb.com): Provides business credit reports and analytics that aid in assessing the financial health and creditworthiness of companies.

Experian (www.experian.com): Offers credit risk assessment tools and fraud detection services, leveraging extensive consumer and business data.

Equifax/Neustar (www.equifax.com / www.home.neustar): Combines credit reporting with identity verification and fraud prevention solutions, utilizing data analytics to detect anomalies.

CreditSafe (www.creditsafe.com): Provides domestic and international business credit reports, scores, monitoring, and benchmarking.

Big Data Risk Intelligence Providers

LexisNexis Risk Solutions / Seisint's Accurint (www.risk.lexisnexis.com / www.seisint.com): Delivers comprehensive risk management tools, including identity verification and fraud detection, by analyzing vast datasets; see below for its digital solution IDVerse.

Refinitiv (World-Check) (www.refinitiv.com): Provides risk intelligence databases for anti-money laundering (AML) and know-your-customer (KYC) compliance, aiding in identifying high-risk entities.

Thomson Reuters CLEAR (www.thomsonreuters.com): Offers investigative tools that aggregate public and proprietary data to support fraud detection and risk assessment

Digital-Native Fraud Platforms

IDVerse (https://idverse.com/): This is a LexisNexis Risk Solutions company that specializes in identity verification using AI-powered biometric authentication and document verification.

Jumio (www.jumio.com): Provides end-to-end identity verification and AML compliance solutions, utilizing AI and biometrics.

Trulioo (www.trulioo.com): Offers global identity verification services, enabling businesses to perform KYC checks across multiple countries.

SEON (www.seon.io): Delivers real-time fraud detection and prevention tools, focusing on digital footprint analysis and machine learning.

Sift (www.sift.com): Utilizes machine learning to provide fraud detection solutions, particularly in the e-commerce sector.

Riskified (www.riskified.com): Offers fraud prevention and chargeback protection services for online merchants, leveraging AI to assess transaction risk.

Forter (www.forter.com): Provides real-time fraud prevention solutions, focusing on e-commerce and digital transactions.

Onfido (www.onfido.com): Specializes in identity verification using document and biometric analysis, catering to various industries.

Vendor Comparative Analysis

Summary of Industry Trends

Integration of AI and ML: Companies are increasingly adopting AI and ML to enhance fraud detection capabilities, enabling real-time analysis and predictive modeling. For more information, click here.

Shift to Cloud-Based Solutions: Organizations are moving towards cloud-based fraud detection systems for scalability and flexibility, allowing for more efficient data processing and analysis. For more information, click here.

Regulatory Compliance: Compliance with regulations like AML and KYC is driving the adoption of comprehensive fraud prevention solutions that can adapt to evolving legal requirements.

Emphasis on Biometric Authentication: The use of biometric data, such as facial recognition and fingerprint scanning, is becoming more prevalent in verifying identities and preventing fraud because businesses don’t commit fraud; people do.

Comparative Overview of Digital-Native Identity Verification and Fraud Prevention Platforms

The commercial fraud prevention landscape is characterized by a diverse array of players, each offering unique solutions tailored to specific market needs. Traditional credit agencies provide foundational data and risk assessments, big data intelligence providers offer in-depth analysis and compliance tools, while digital-native platforms deliver agile, technology-driven solutions. As fraud tactics continue to evolve, the integration of advanced technologies and adherence to regulatory standards will be crucial in developing effective fraud prevention strategies and should include the use of leading digital-native identity verification and fraud prevention platforms.

Key Insights into Digital-Native Identity Verification and Fraud Prevention Platforms

AI and Machine Learning Integration: Platforms like Socure and Onfido leverage AI and machine learning to enhance the accuracy and efficiency of identity verification processes. For more information, click here.

Global Compliance: Jumio, Trulioo, and Veriff emphasize compliance with international regulations such as KYC and AML, making them suitable for businesses operating across borders. For more information, click here.

Customization and Flexibility: Persona and Onfido offer customizable workflows, allowing businesses to tailor the verification process to their specific needs.

Comprehensive Identity Management: ForgeRock provides a broad suite of identity and access management solutions, catering to complex enterprise requirements.

Strategic Considerations for Digital-Native Identity Verification and Fraud Prevention Platforms

Scalability: For businesses anticipating growth, platforms like ForgeRock and Trulioo offer scalable solutions that can adapt to increasing verification demands.

User Experience: Platforms such as Veriff and Persona focus on providing a seamless and user-friendly verification process, which can enhance customer satisfaction.

Risk Mitigation: Socure's predictive analytics capabilities can be instrumental in proactively identifying and mitigating potential fraud risks.

Call to Action

As leaders in trade credit and liquidity, you should utilize top commercial fraud prevention services. Key factors include AI and machine learning integration, global compliance, customization, identity management, scalability, user experience, and big data capabilities. Combining these tools optimizes identity verification, improves security, and ensures a smooth user experience. By adopting advanced, scalable platforms, businesses can excel in the digital age while still using traditional credit reporting and big data analytics.