Dun & Bradstreet Might Go Private . . . Again

Veritas Capital Fund Management is in discussions to acquire D&B Holdings Inc.

Dun & Bradstreet Holdings, Inc. (NYSE: DNB) has experienced significant ownership and valuation changes over the past few years. Most recently, according to a Bloomberg report by Ryan Gould, Matthew Monks, and Liana Baker report, citing people familiar with the matter, Veritas Capital Fund Management is in discussions to acquire Dun & Bradstreet Holdings Inc. The deal is said to value Dun & Bradstreet at around its current market capitalization of approximately $5.4 billion USD. However, no final decision has been made yet, and the discussions could still fall through.

2019 Acquisition by Private Equity Group

In August 2018, Dun & Bradstreet entered into an agreement to be acquired by a private equity group led by Bill Foley, which included CC Capital Partners, Cannae Holdings, Bilcar, Black Knight, and Thomas H. Lee Partners. The transaction was valued at approximately $6.9 billion, including debt, and was completed on February 8, 2019.

2020 Initial Public Offering (IPO)

Dun & Bradstreet returned to the public markets with an initial public offering on July 1, 2020. The IPO was priced at $22.00 per share, resulting in gross proceeds of approximately $2.38 billion when combined with a concurrent private placement. This offering valued the company at close to $9 billion, excluding its total debt of more than $9.1 billion at that time. After the IPO was completed, Cannae Holdings Inc., an investment firm spun off from Bill Foley-controlled Fidelity National Financial, was the largest shareholder with 17.8% of the stock.

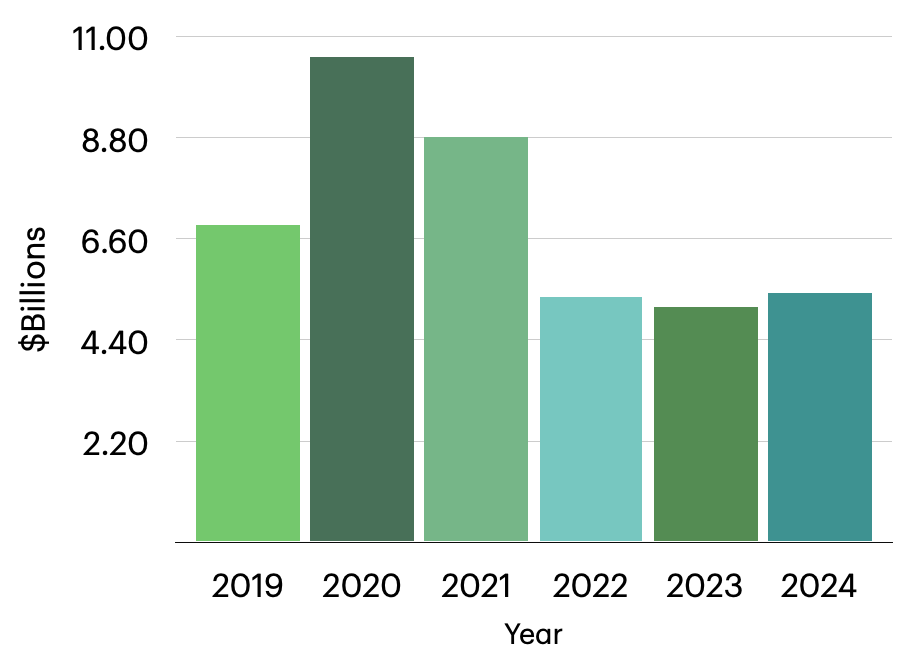

DNB's Market Capitalization Has Experienced Fluctuations

These changes reflect a general downward trend since going private in 2019, with a slight recovery in 2024. In August 2024, Dun & Bradstreet confirmed receiving takeover interest and engaged Bank of America to evaluate potential offers.